The Mobile Money Ecosystem, Europe

Written by Julaire HallIf you’re new to this space, welcome to our mobile money ecosystem mini-series where we explore the evolution and landscape of mobile money in particular regions around the globe. If you have not yet done so already, please feel free to read the post on Africa, Asia-Pacific, and Latin America & the Caribbean. Today, per the title, we will be exploring highlights of what’s happening in Europe. Let’s talk about it!

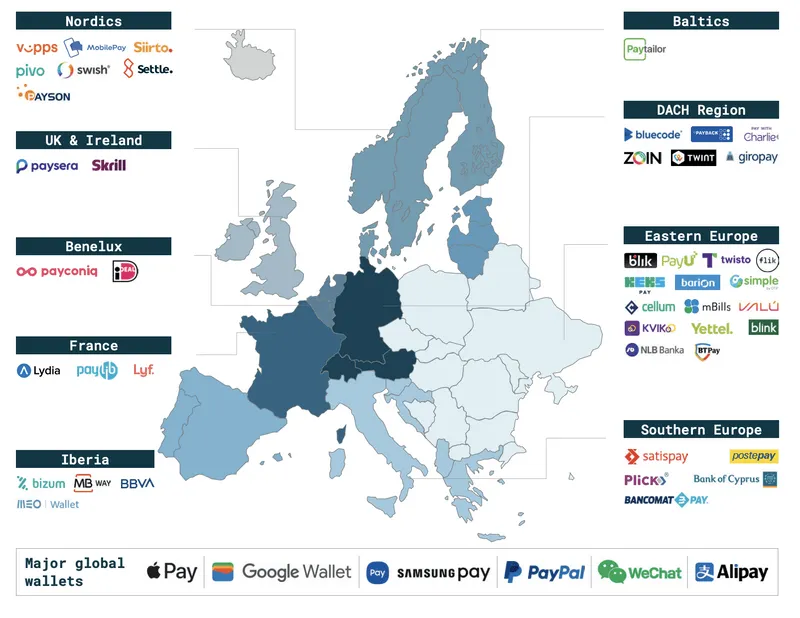

Whilst cash remains king in certain countries like Romania and Germany, the advancement in wireless technology and 5G capabilities have enabled spurring growth in fintech solutions in Europe; coupled with country-mandated policies enabling digital payment options in many territories. Take the Swedish government for instance launching its national digital wallet - Swish which is currently being used by over two-thirds of its population. In other territories, payment systems, like BLIK (Poland), TWINT (Switzerland), Bluecode (Austria, and iDeal (Netherlands), are offering from contactless payment via mobile phone to the ability to conduct e-commerce, bill payment, and other online transactions.

On a multi-country level, there are also efforts geared towards enabling partnerships resulting in value-added, interoperable, cross-border transactions. European Mobile Payment Systems Association (EMPSA) via its collaborative approach has yielded successful interoperability tests between Bancomat Pay (Italy), TWINT (Switzerland), and Bluecode (Austria). Digital Wallets is certainly a turning point for payments in Europe. The European Union has also initiated the creation of its digital identity wallet that will enable storing of data, payments, and other financial services via online channels.

To get further insights on Europe’s mobile payment landscape, you may preview the 2024 European Mobile Payment Report by Arkwright.

Whilst the thrust is to offer alternatives to cash payment, card payments have held their dominance in Europe for many years. As technological innovations yield digital services, the card market has grappled with evolving its service offerings to remain competitive and dominant within the payment landscape. Payment providers such as Visa and MasterCard have partnered with varying fintechs to deploy contactless and mobile payment services across Europe. Big tech wallets such as Apple Pay, PayPal, Google Pay, and Samsung Pay have established their presence by enabling high-value purchases, and quick offline payments, and offering a sense of security and smooth experience that consumers seek.

With more digital wallets available in Europe, the trend of using mobile devices for making payments is only increasing and is expected to grow lucratively over the next few years.

Let’s get a sense of how you pay.

From a wallet with a stack of cards (debit and credit) or the convenience of your smartphone or smart device?

It is not a one-size-fits-all-all, so I am sure it varies. So, let us know in the comment below, how you pay.

Julaire is a highly accomplished project and program management professional with 10+ years of extensive experience in planning, executing, and overseeing the successful delivery of programs in government and the global services sector.